Before entrepreneurs can start and build their entity in the Philippines, they must register or incorporate their company with various government agencies to operate legally in the country. Our end-to-end company incorporation services can help ease the process of registration.

What We Offer

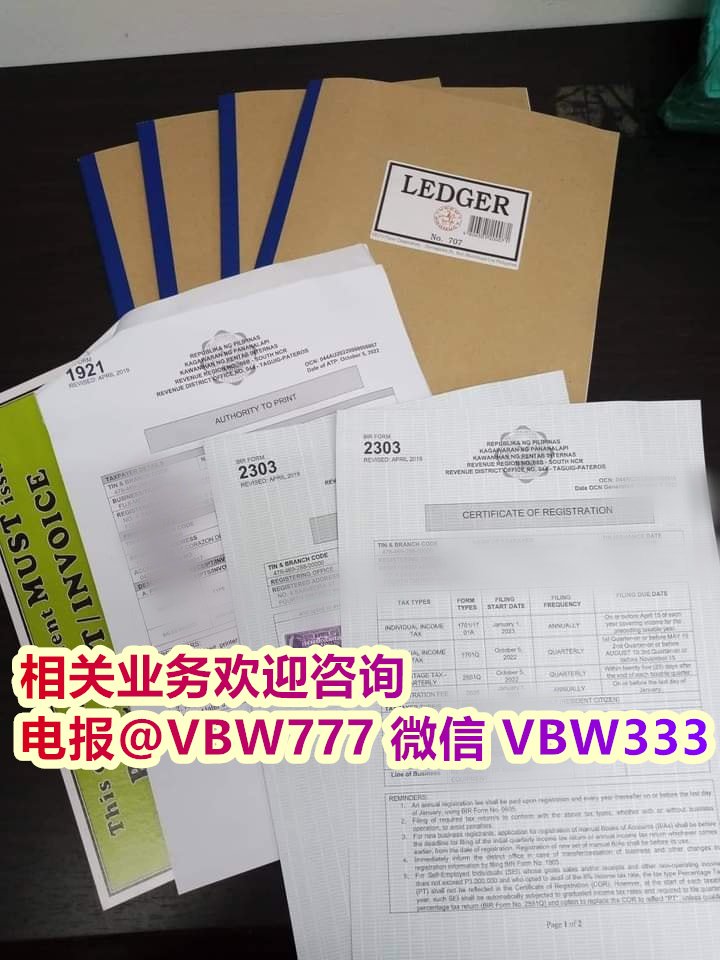

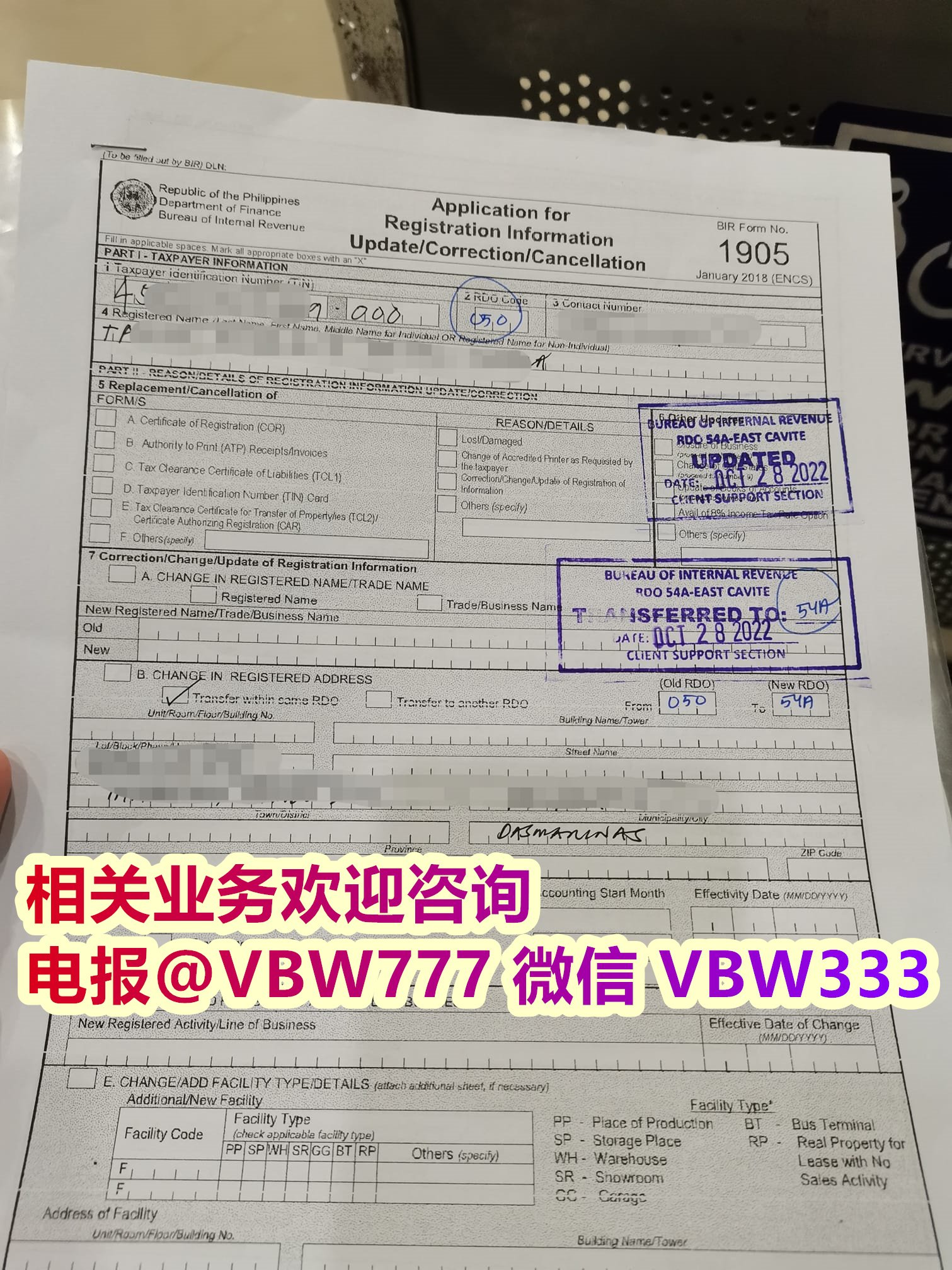

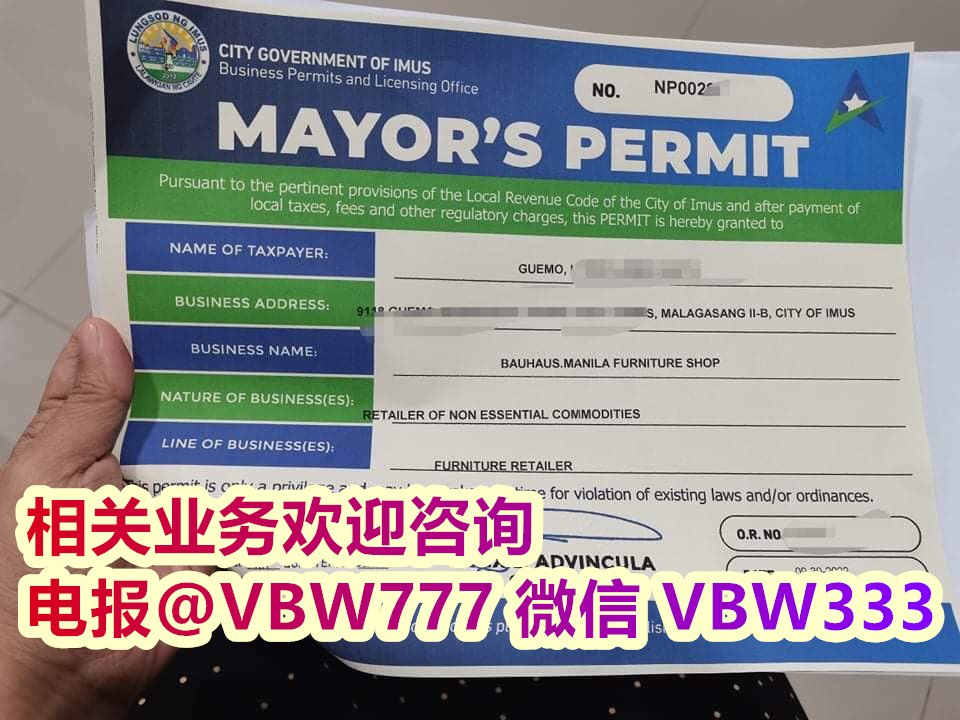

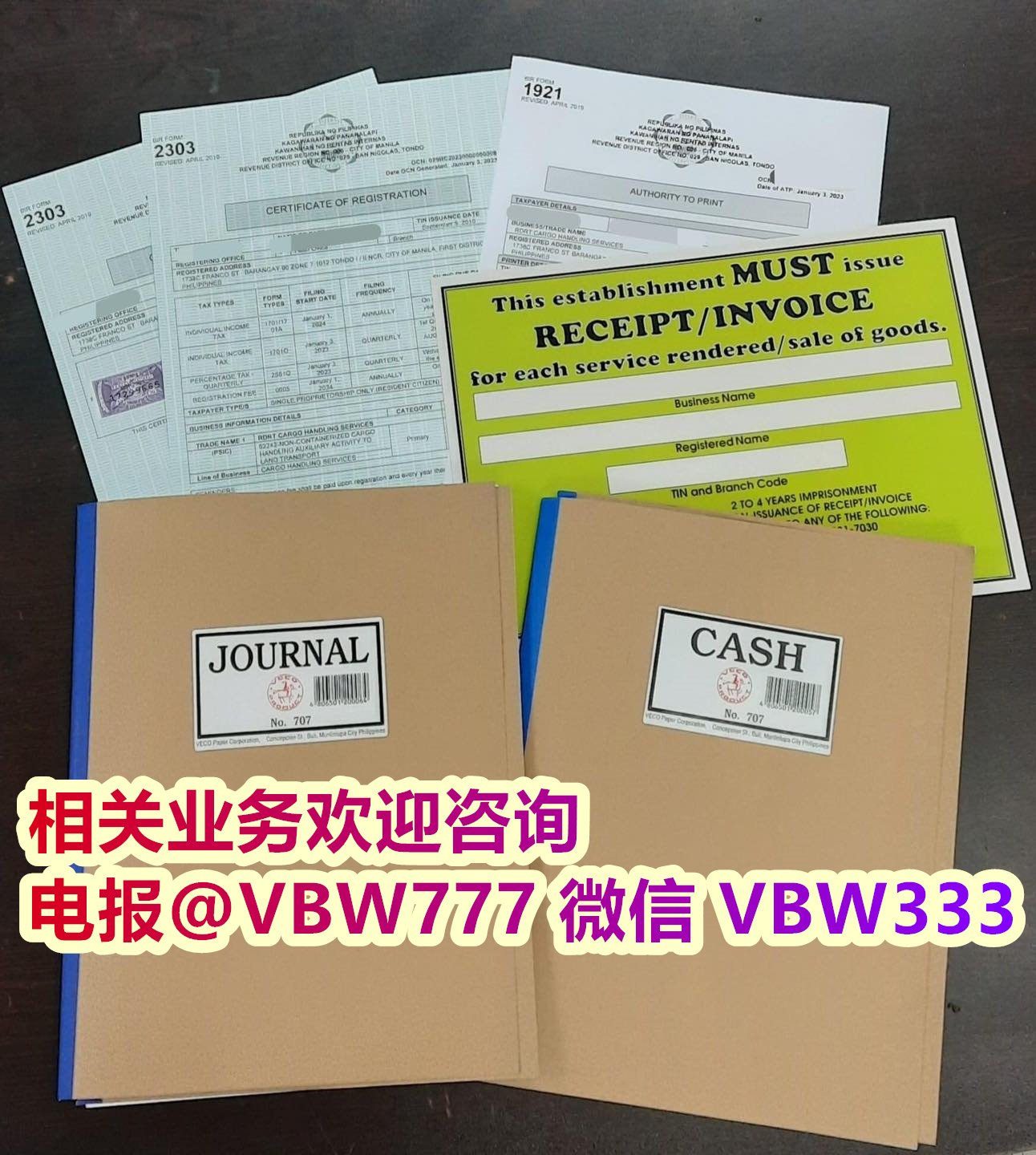

Before starting and operating a business in the Philippines, there are several registrations and requirements that need to be done. We offer end-to-end assistance in the following areas:

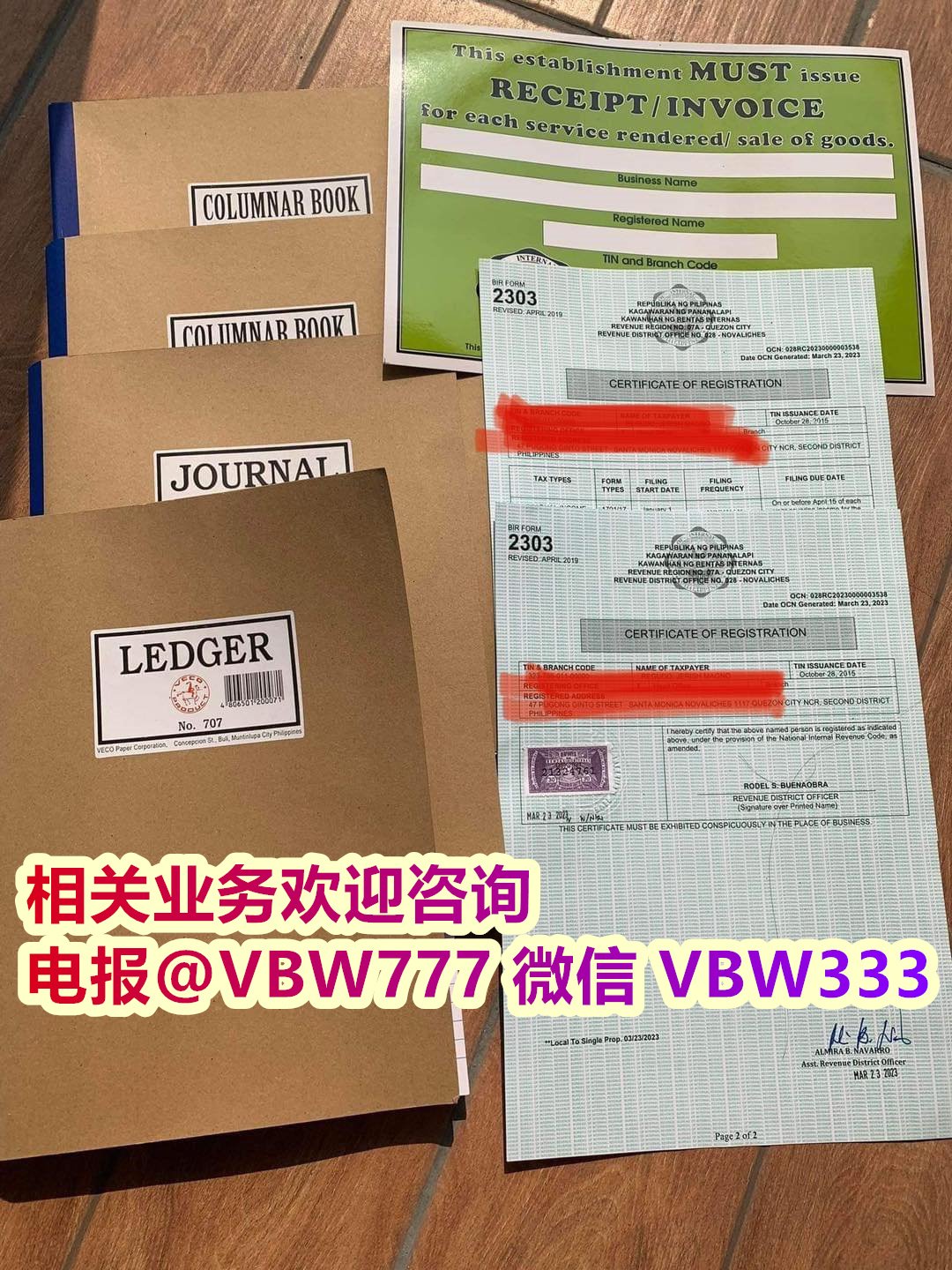

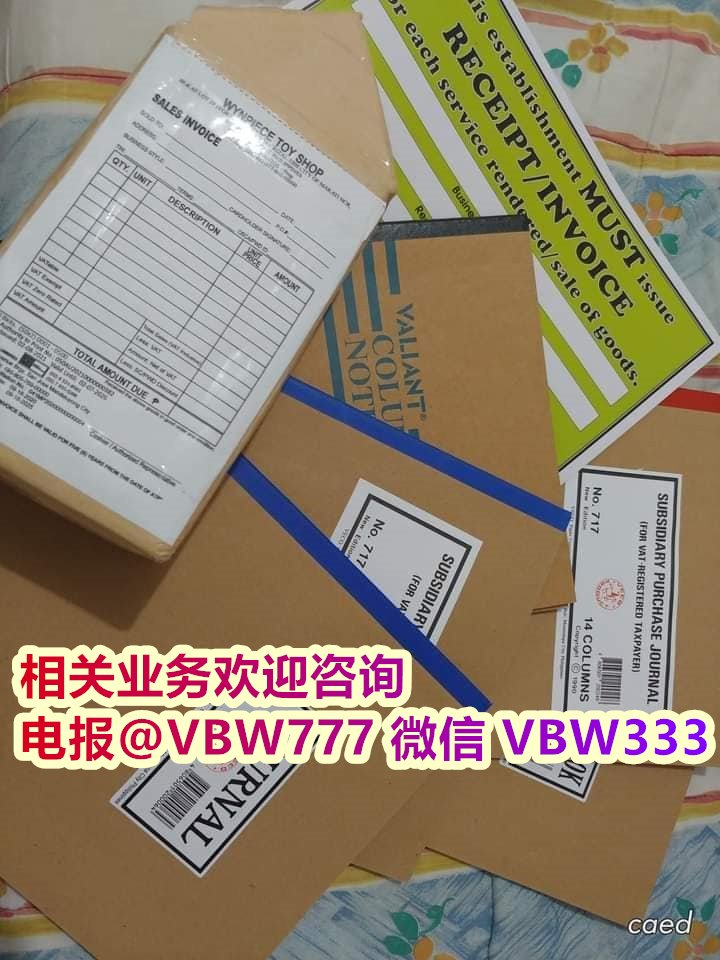

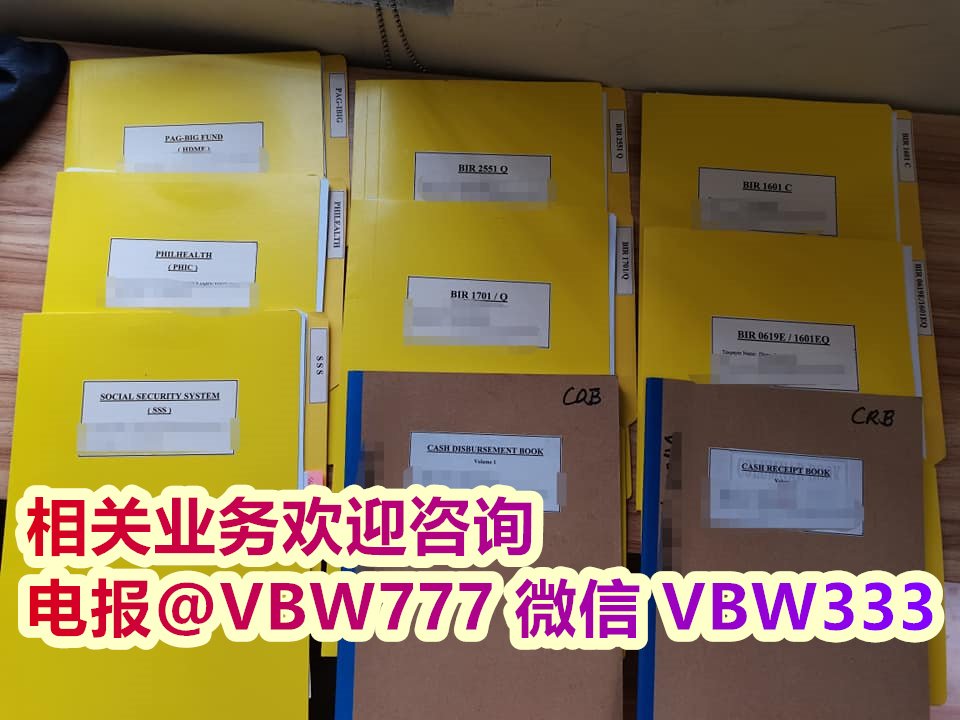

Company incorporation

Corporate secretarial work

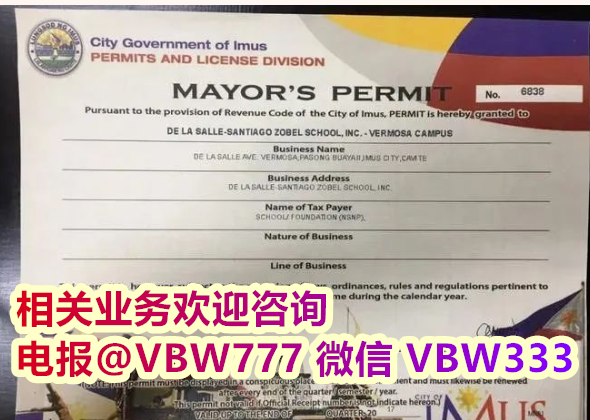

Corporate housekeeping to application for secondary licenses/permits

Corporate restructuring

General compliance work

We also help clients choose the right type of business entity to register, depending on whether their purpose is to generate income or build a back office in the country. Aside from the services mentioned above, we also assist clients in evaluating the following:

Ownership structure

Capital requirements on the industry to engage in

Need for special or secondary licenses/permits (if they intend to engage in regulated industries)

Location of business

Staffing requirements to assess the approximate size of their office space and facilities

Types of Business Entities for Foreign Investors

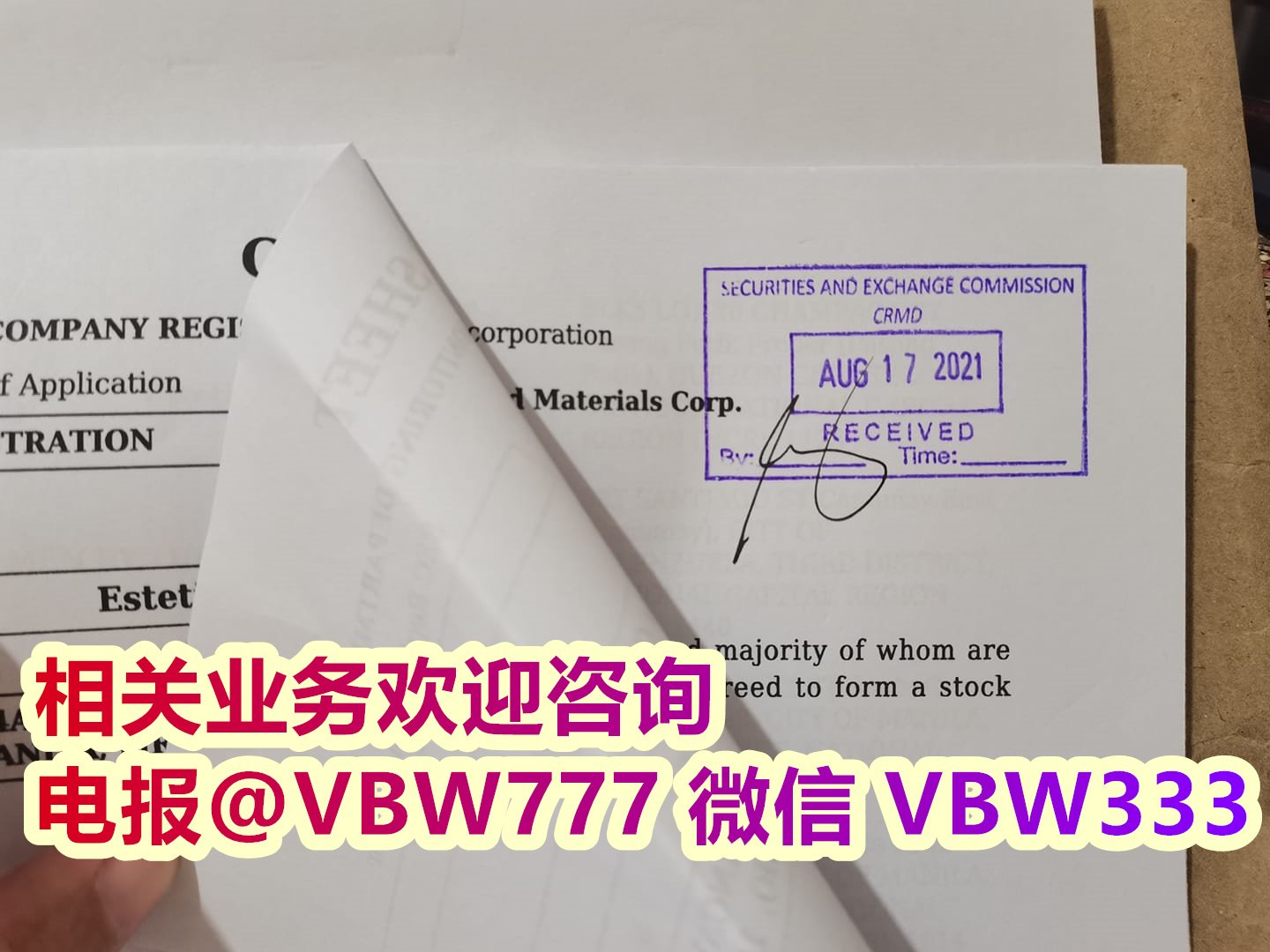

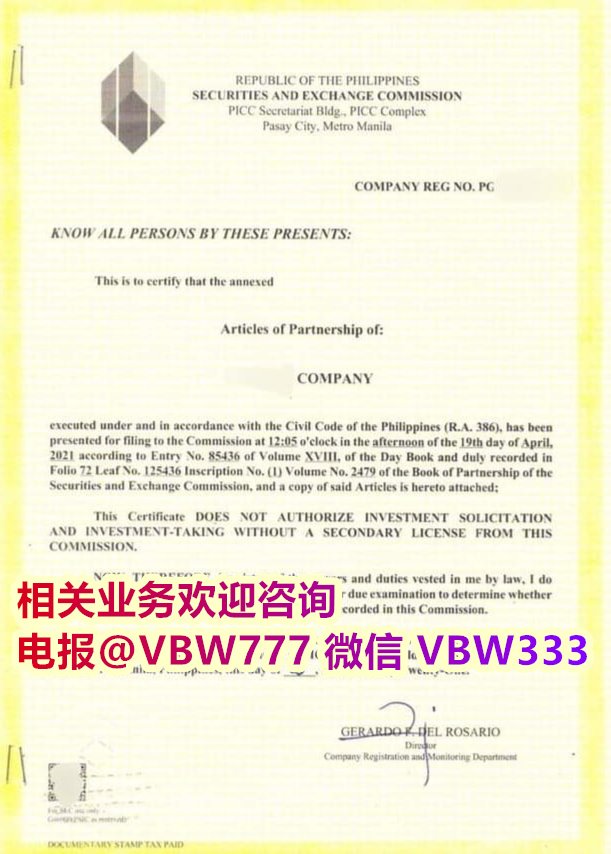

Foreign nationals who wish to incorporate an entity here in the Philippines must register with the Securities and Exchange Commission (SEC).

Corporations with foreign equity are allowed to set up businesses in the Philippines. Except in areas of investment included in the Foreign Investment Negative List (FINL), the industries included in the FINL are partially or wholly exclusive to those Filipino entrepreneurs. All in all, there are six types of legal entities that can be registered by foreign nationals when they start building their business in the Philippines, depending on the course of action they want to pursue.

Foreign Investors Seeking to Establish a Local Company

There are two types of legal entities that can be registered for those foreign nationals seeking to establish a business in the Philippines. Below are the following options:

Domestic Corporation

Domestic Corporation (or Subsidiary Corporation if with foreign equity) is the most common type of corporation in the Philippines. Its legal entity is separate from its shareholders and is required to have at least five incorporators, which must be natural persons of legal age and subscribers of at least one share of capital stock in the corporation.

Under Philippine law, natural persons are those who are Philippine citizens from birth. A natural person only qualifies as a legal person to the extent that they are the sole holders of the protected interests that legal entities are not entitled to.

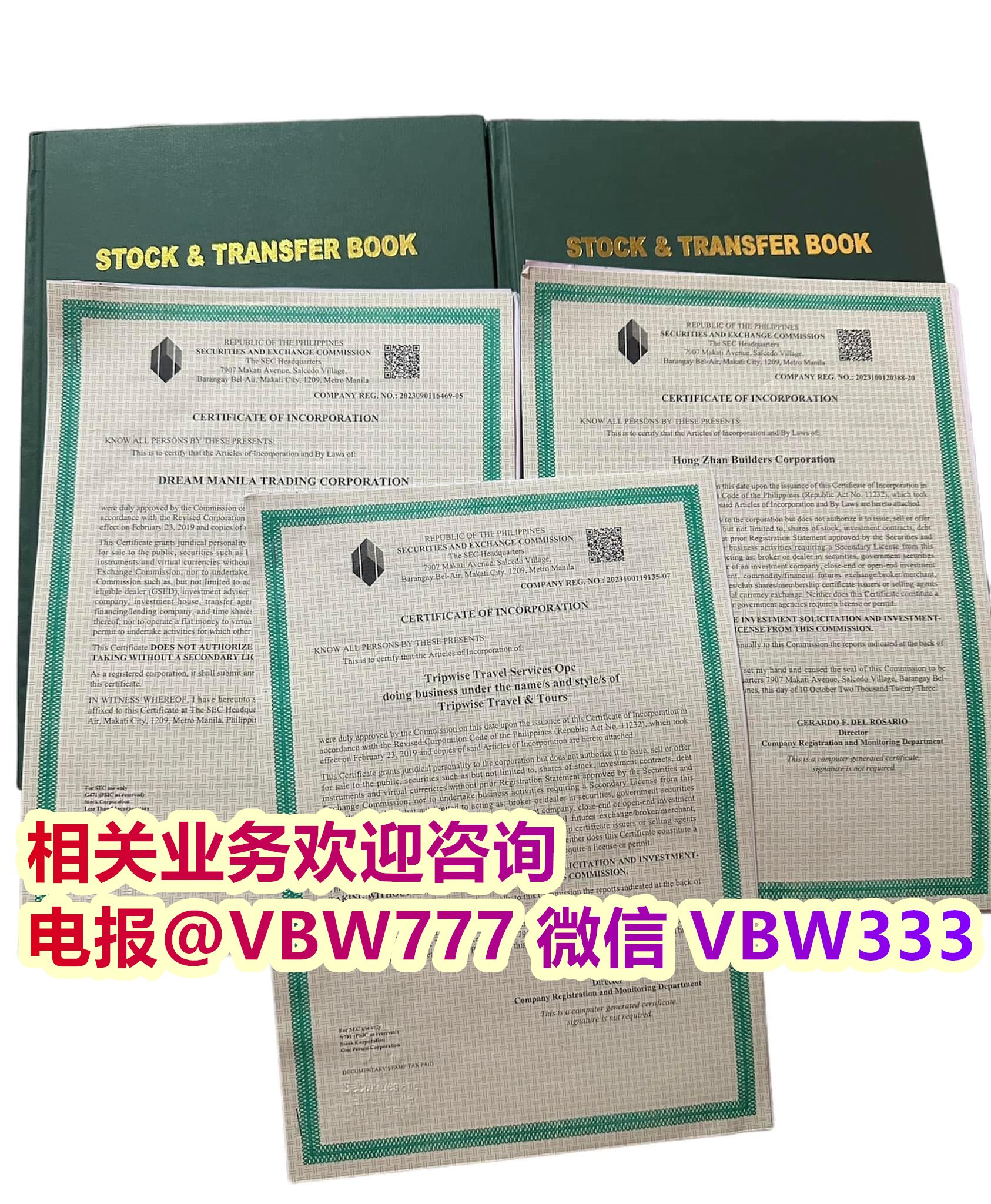

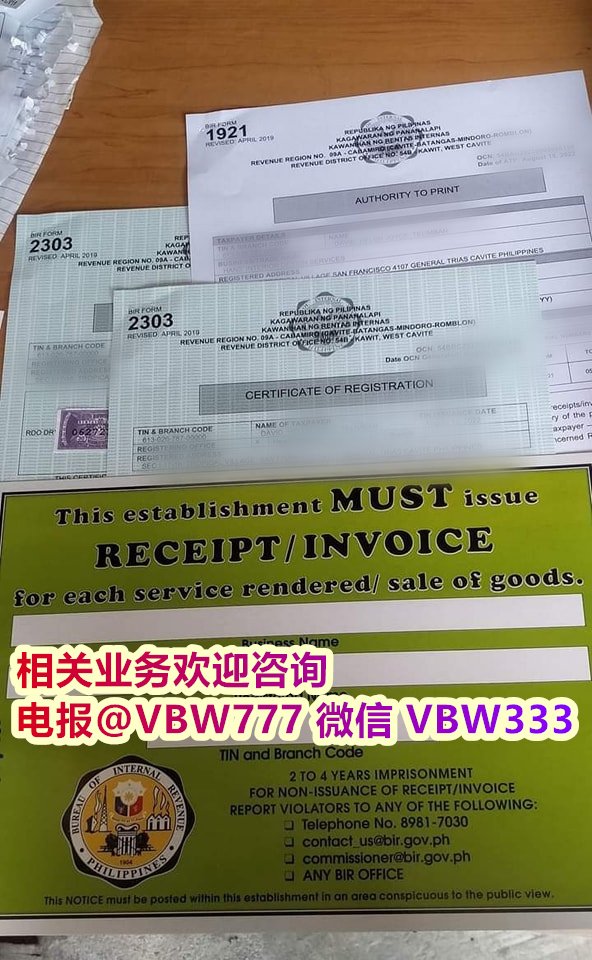

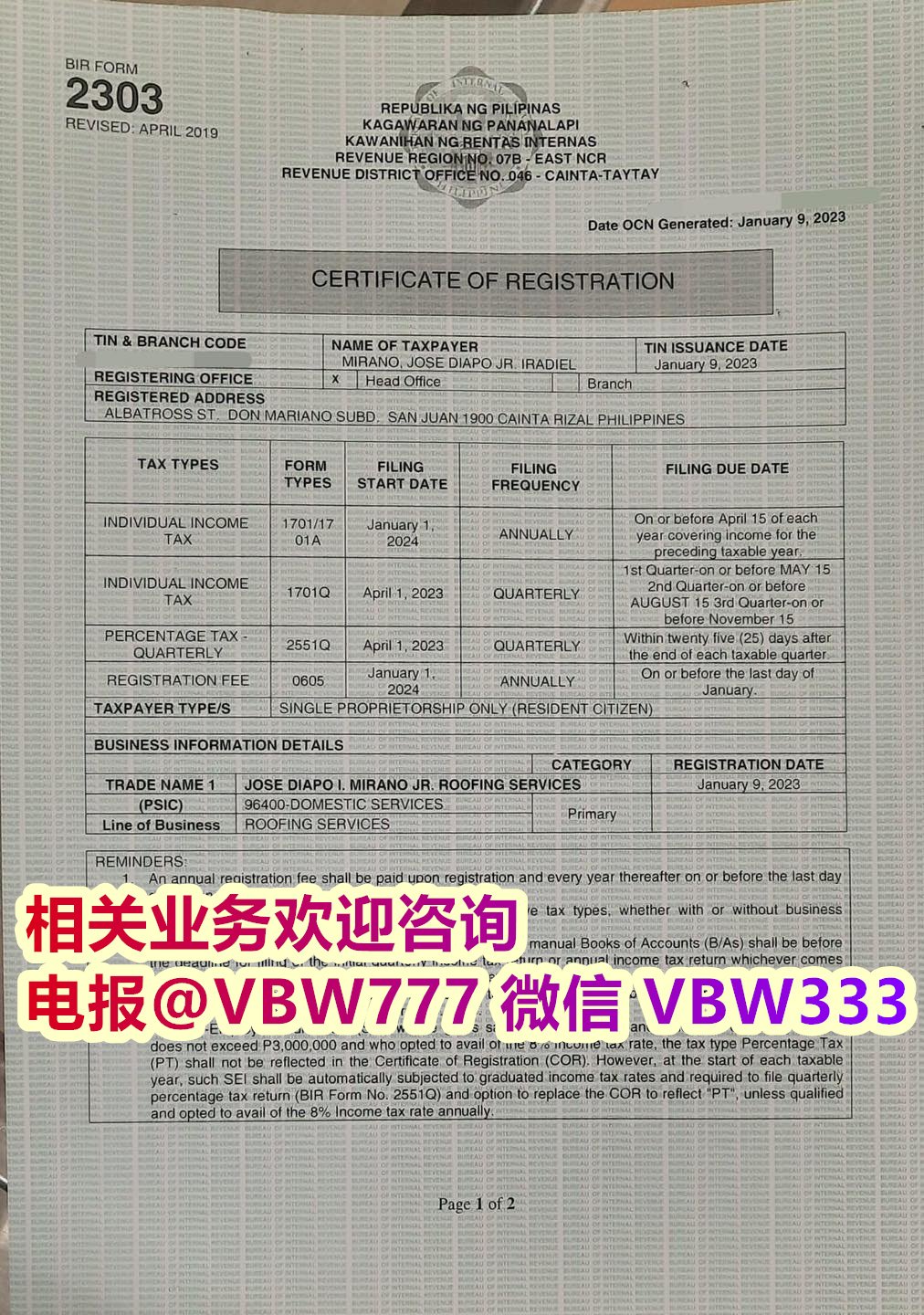

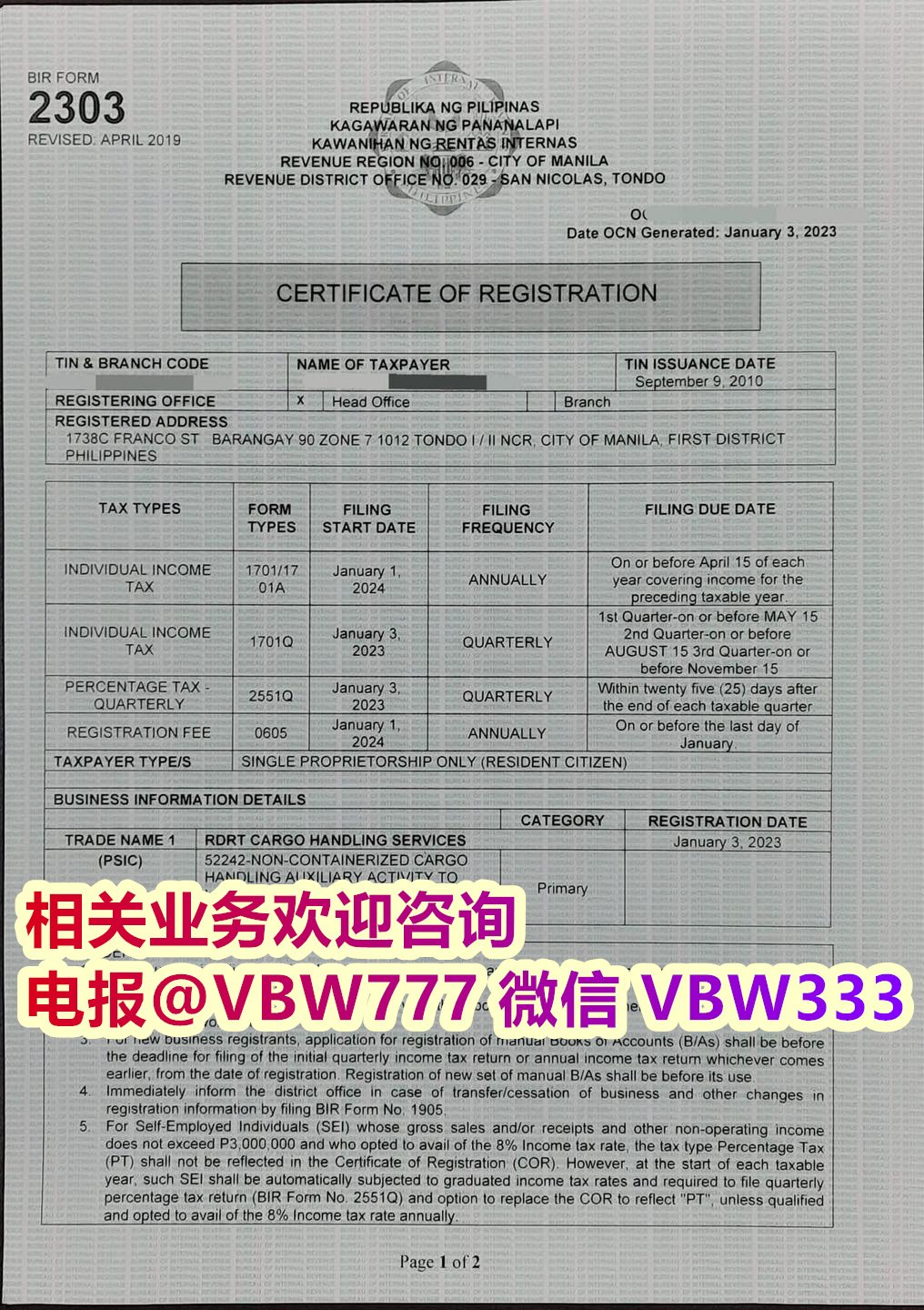

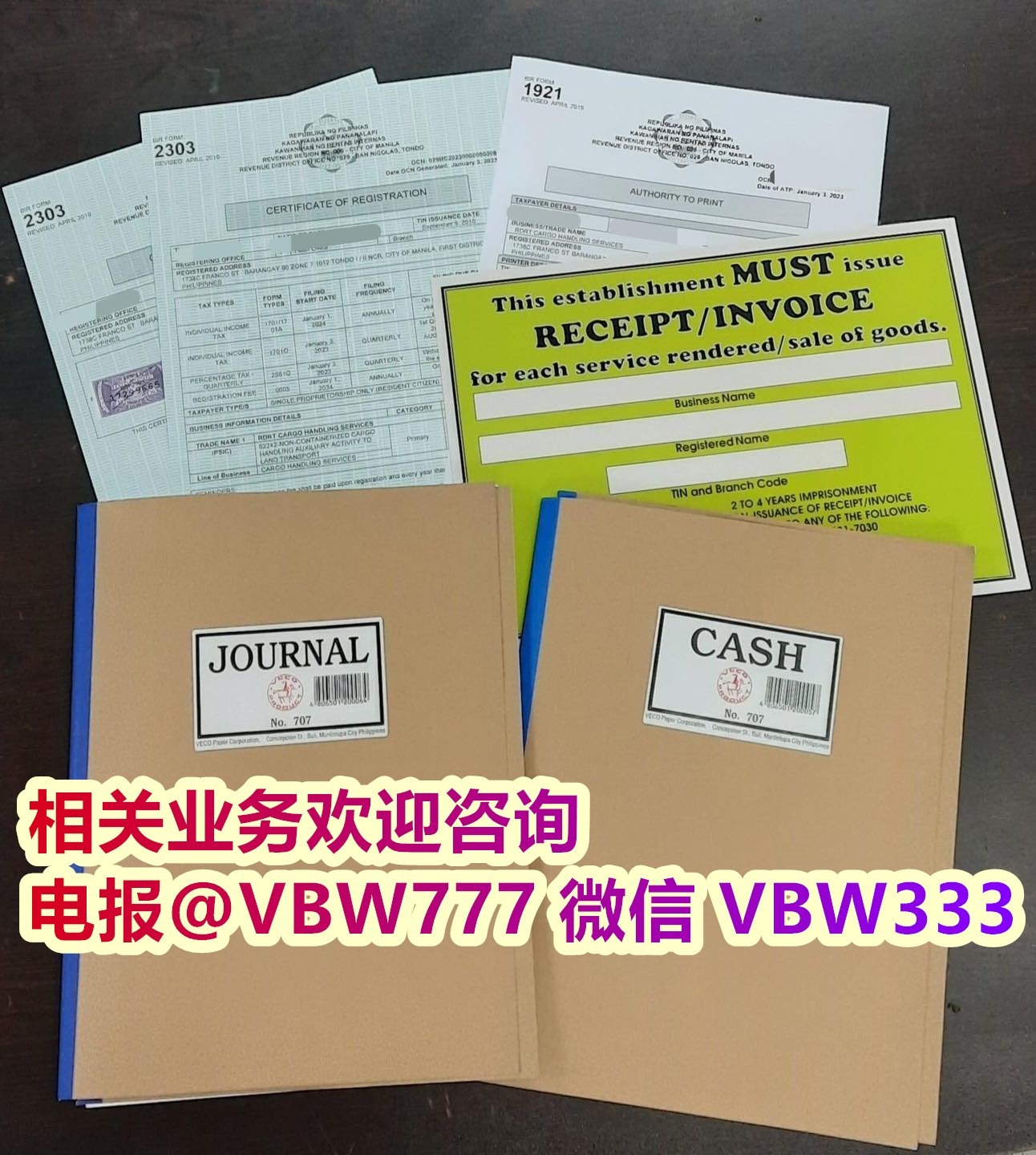

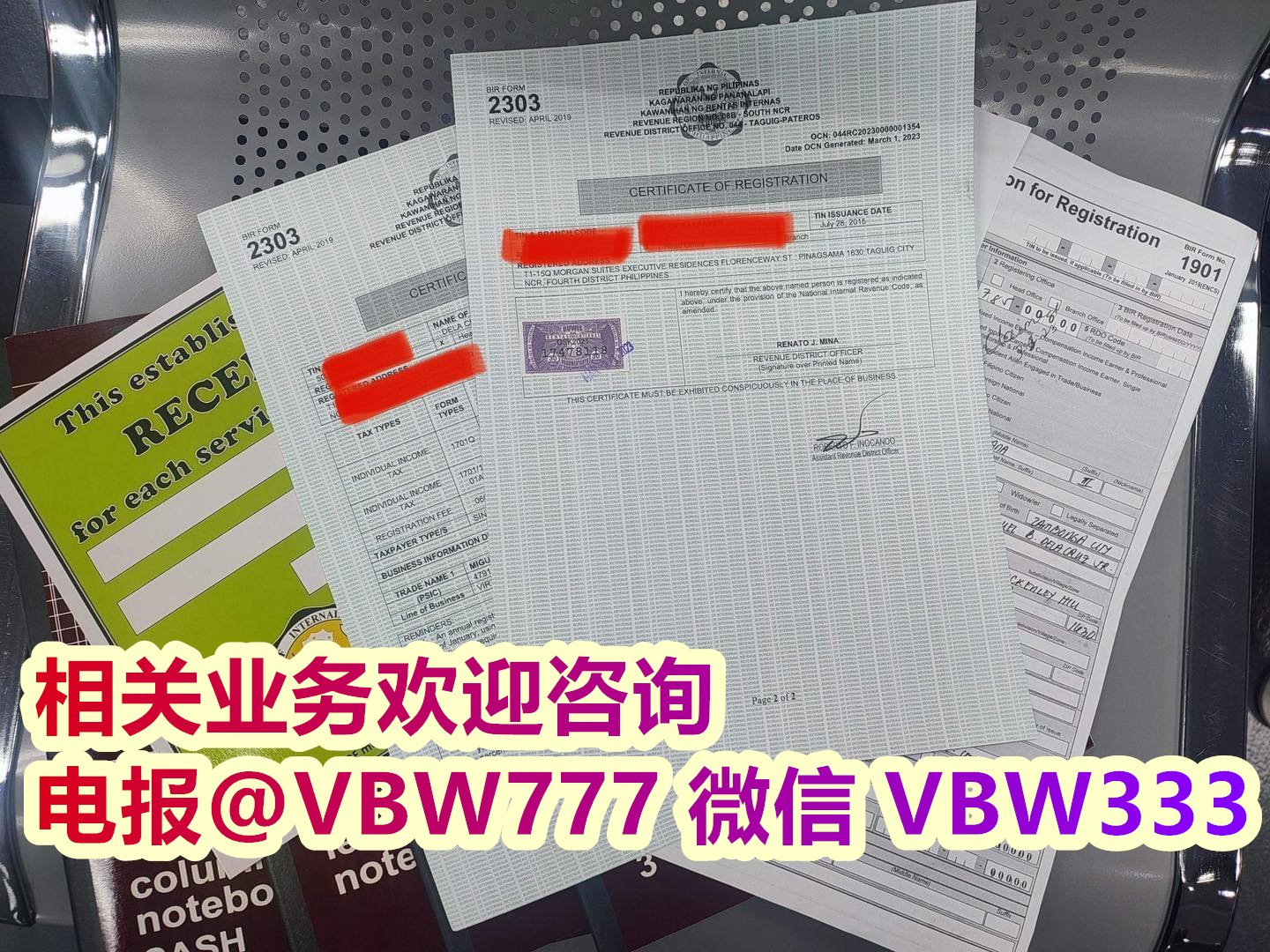

This type of corporation is required to acquire a Certificate of Incorporation and a Certificate of Registration from the SEC. A Certificate of Incorporation legitimizes its existence as a corporation and is currently operating in accordance with Philippine legislation. On the other hand, the Certificate of Registration authorizes it to engage in business inside and outside the Philippines.

There are three types of domestic corporations in the Philippines:

100% Filipino-Owned Domestic Corporation

60% Filipino-Owned and 40% Foreign-Owned Domestic Corporation

40% to 100% Foreign-Owned Domestic Corporation

A domestic corporation’s minimum capital requirement will rely on its revenue source, which may be any of the following:

Export-Market Enterprise. When a company’s revenues are at least 60% generated outside the Philippines, the minimum paid-up capital will be US$100.

Domestic-Market Enterprise. Otherwise, if the company’s revenues are 40% generated within the Philippines, the minimum paid-up capital is US$200,000.

One Person Corporation (OPC)

A One Person Corporation (OPC) is a type of corporation with a single stockholder who shall also be the sole director and president. It offers the full authority and control of a sole proprietorship and the limited liability of a domestic corporation, an ideal setup for aspiring entrepreneurs planning to run a corporation on their own without the associated risks of incurring personal liabilities and having business partners.

The single stockholder (also known as incorporator) can be a natural person of legal age, a trust or an estate. Under applicable laws, the trust does not refer to a trust entity, but to the subject being managed by a trustee.

Similar to a Domestic Corporation, an OPC is also required to obtain a Certificate of Incorporation and a Certificate of Registration from SEC.

A foreign natural person can set up an OPC, provided they engage in areas of investment not restricted from foreign participation.

Unlike other types of corporations, an OPC is not required to have a minimum authorized capital stock, except as otherwise provided by law. Further, unless stated by applicable laws or regulations, no portion of the authorized capital is required to be paid up at the time of incorporation.

The single stockholder is required to designate a nominee and alternate nominee who shall be indicated in the Articles of Incorporation to replace the single stockholder if they die or become incapacitated to operate the OPC.

For Existing Foreign Corporations Seeking to Expand in the Philippines

Aside from building an entity in the Philippines, existing foreign corporations can also expand in the country. The following are the type of offices and headquarters you can register in the Philippines:

Branch Office

A branch office is a corporate entity that generates revenue by representing its overseas parent company’s operations in the Philippines. It does not have an independent legal identity from its parent firm, and the head office’s international operations are responsible for its responsibilities.

A branch’s office minimum paid-up capital is US$200,000.00, but can be reduced to the following:

If it engages in business activities that involve technology or employ at least 50 direct employees, the paid-up capital will be US$100,000.00

If it seeks to be an Export-Market Enterprise that generates income overseas, the paid-up capital will be US$100.00

Representative Office

Unlike a branch office, a representative office is a non-income-generating entity. A foreign firm may establish a representative office, in the form of a back office or contact center, where they can outsource their administrative and technical operations, such as the ones listed below:

Promote company services/products

Facilitate client orders from abroad

Perform quality control of products for export

A representative office does not have a separate legal entity from its foreign parent company, and its liabilities are acquired by the head office overseas. Since it is a non-generating income entity, they are not permitted to offer services to clients or third parties in the Philippines.

Moreover, the minimum capital requirements of a representative office are US$30,000.00.

Regional Headquarters (RHQ)

A regional headquarters is also a non-income-generating entity that can only be set up by foreign corporations with subsidiaries, branches, and affiliates internationally. It can be established in the form of a contact center or back office to oversee, check, or organize the administrative tasks.

In addition, it may procure raw materials, market goods, provide employee training, and carry out research and development in the Philippines within the circumstances permitted by law. It also has no legal distinction from its parent firm, and its head office in another country is responsible for all of its obligations.

Under Philippine laws, an RHQ is not permitted to perform the following:

Generate income or offer services to third parties in the Philippines

Manage the operations of its subsidiaries, branches, and affiliates

Deal directly or do business with its clients in the Philippines

Its parent company is also not permitted to sell or market products through the RHQ office.

The minimum capital requirement for setting up an RHQ is US$50,000.00, which shall be annually remitted by the parent company to support operating expenses.

Regional Operating Headquarters (ROHQ)

Regional Operating Headquarters are among those entities which are considered income-generating that carry out the business activities of its foreign parent company into the Philippines. Only foreign corporations with affiliates, subsidiaries, and branches globally are permitted to establish it as a service hub for the businesses that belong to the parent company.

Moreover, under Philippine law, it is prohibited to directly or indirectly solicit or market products and services on behalf of its parent company, subsidiaries, branches, and affiliates. Aside from this, an ROHQ is also not allowed to offer qualifying services to third-party enterprises other than its associated entities.

Furthermore, the parent company is required to remit at least US$200,000 yearly to support the entity’s operational costs.

Expand Your Business Operations in the Philippines

As the Philippines grows to be – an up-and-coming business hub in the ASEAN region, the country has numerous opportunities to offer, such as high-caliber talents, beneficial tax incentives, and so on. That being said, entrepreneurs seeking to expand their businesses see potential growth in doing business in the country.

If you want to know more about starting and expanding your business in the Philippines, you may reach out to business consulting firms to help you with the registration process and acquire the necessary business licenses to operate in the country smoothly.

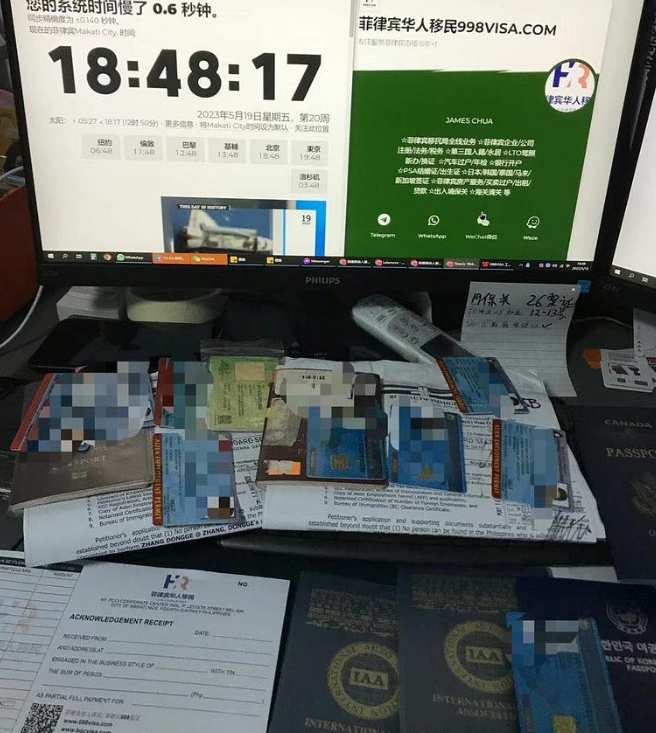

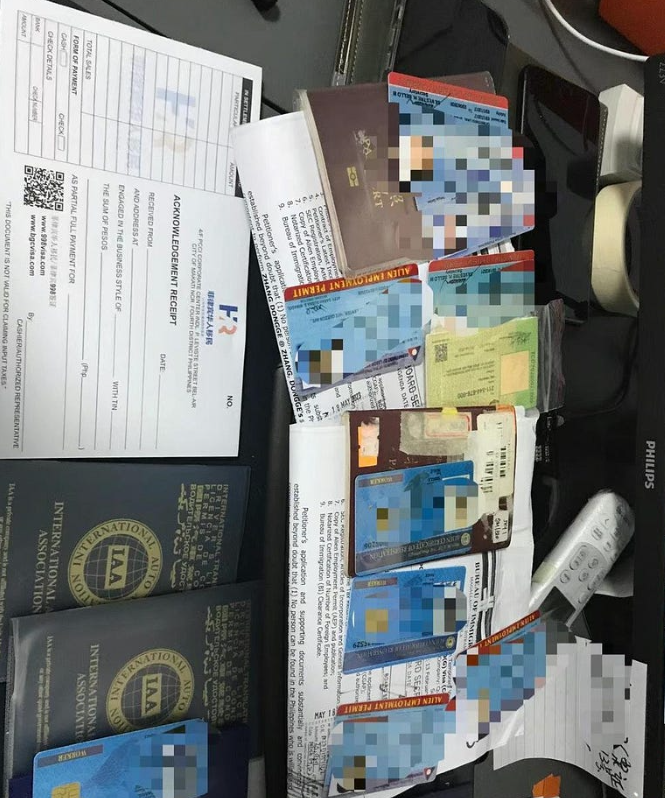

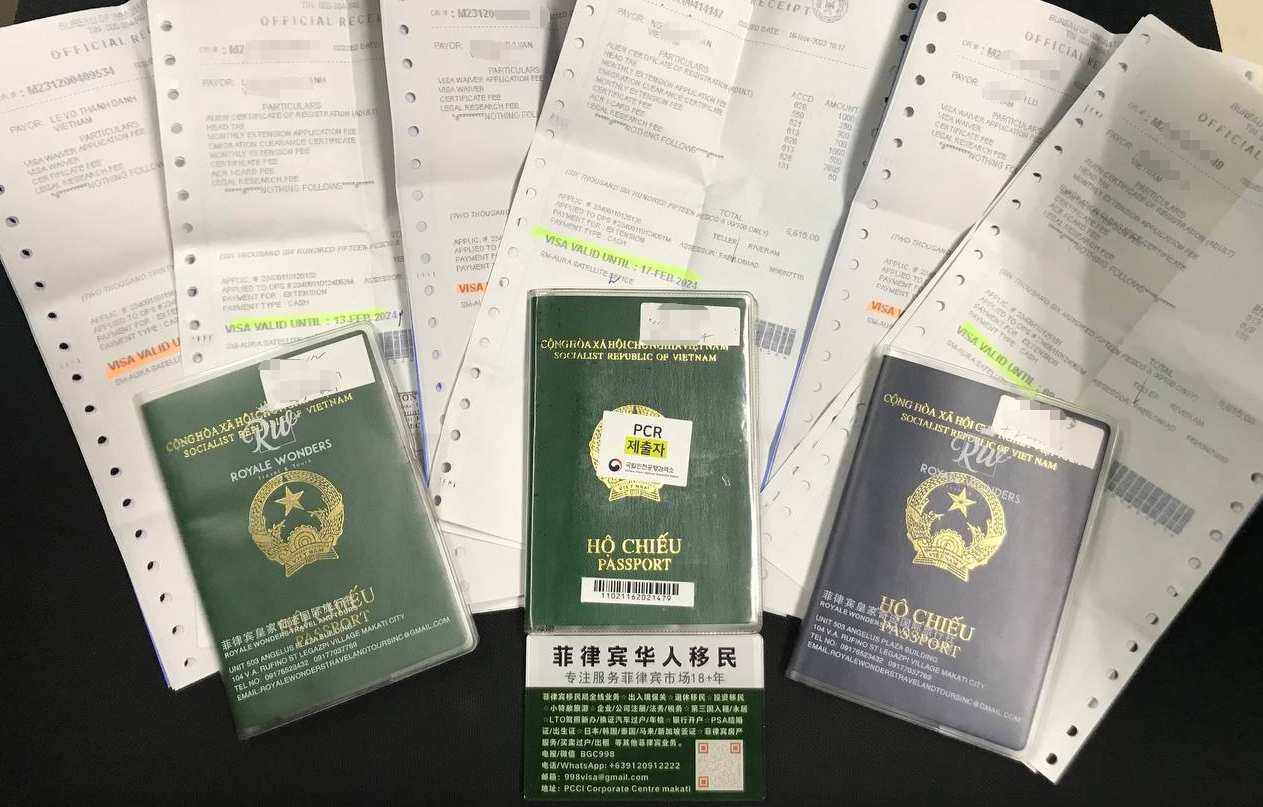

We process:

Air tickets, hotels, travel /Government File processing

1. 9G Working Visa(1-3Years)

2. 13A / MCL21 TRV Spousal Visa- married to a Filipino citizen

4. Tourist Visa Extension

5. Alien Employment Permit (AEP) / Special Working Permit (SWP)

6. Inclusion of dependent Spouse and unmarried child

7. Emigration Clearance Certificate (ECC)

8. Cancellation /Apply of Alien Employment Permit replacement (loss AEP)

9. Cancellation of CEZA Working Visa (CWV)

10. Cancellation of 9G Working Visa (9G)

11.Special Resident Retiree’s Visa (SRRV) SIRV ASRV

12. Quota Visa SEC13

13. Overstay MR

14. Lifting of Blacklist(BL) and Hold Departure Order (HDO)

15. Order To Leave (OTL)

other Immigration related concern:

Alien Registration

Annual Report (A.R)

ACR I-CARD Issuance

Voluntary Application for ACR I-CARD

Renewal ACR I-CARD

Re-Issuance of ACR I-CARD

ACR I-CARD Waiver

Cancellation of ACR I-CARD

Philippine-Born Registration

Certification for Not the Same Person

ACR I-CARD Certification

BI Clearance Certification

Pending Visa Application Certification

Certified True Copy Certification

Travel Records Certification

Certificate of Non-Registration / Registration

Application for Retention / Re-acquisition of Phil. Citizenship

Inclusion of Dependents under R.A. 9225

Recognition as Filipino Citizen

Affirmation of Recognition as Filipino Citizen

Cancellation of Alien Certificate of Registry (ACR)

Special Study Permit

Provisional Work Permit

Special Work Permit – Commercial

Special Work Permit – Artists & Athletes

Joining Filipino Seaman

Signing Off Filipino Seaman

Joining Foreign Seaman

Repatriating Foreign Seaman

Filipino Supernumerary

Foreign Supernumerary

Penalty on Late Filing / Non-Filing of Foreign Seafarer’s Notice of Arrival (Joining Crew)

Administrative Fine Imposed on a Foreign Crew Member if Not Properly Documented

Penalty for Late Filing / Non-Filing of Notice of Departure

Waiver for Exclusion Ground

Downgrading of Visa

Transfer of Admission Status

Amendment / Correction of Admission

Re-Stamping of Visa RA 7919

Re-Stamping of Visa

Failed to Stamp – Encoded

Failed to Stamp – Not Encoded

Interim Extension (Grace Period)

please feel free to contact us:

English/Tagalog Inquiries :

WeChat : dpylanayon

WhatsApp :+63 939 526 6731

Telegram :@Diadem_Pearl

EMAIL: dplanayon.royalewonders@gmail.com

VIBER:+63 939 526 6731 / +63 9176523432

PHONE:

+639176523432

+639177037769

中文咨询:

微信 : BGC998 (中文)

WhatsApp :+63-912-0912-222 (中文)

电话: :+63-912-0912-222(中文)

电报/小飞机:@WOW888 (中文)

net business

net business

rom 2017-2022.

rom 2017-2022.